When planning for a sector, it is essential to know its direction of travel. Monitoring which aspects have been significant over the previous year helps clarify which will continue to be so going forward. Following a year of strong growth, it is generally agreed that the renewables sector will keep expanding in 2024, in parallel with the requirements of the energy transition.

A much bigger sector offers huge opportunities for asset management, especially in Europe. The hugely increased size and prevalence of solar farms means the sector is no longer seen as a cottage industry. Naturally, this also brings new challenges, not least of which is the heightened need for Asset Management professionals to remain on top of their game and approach tasks with renewed professionalism. To meet this goal, it’s essential to know the issues that will characterise the year ahead.

Solar power soared in 2023

Last year saw the largest ever annual increase in new renewable capacity. According to the IEA, capacity rose by a third, growing to 450GW worldwide by the end of the year. Solar PV made up two thirds of the increase, and in 2024 could reach 550GW. In fact, by September solar had produced more electricity in 2023 than the whole of the preceding year. The key reasons for this will remain pertinent in 2024:

- Energy cost. Solar is now the cheapest form of energy in every country where it is viable, with the cost of components – and especially PV panels – plunging in 2023.

- Energy security. The events of the past two years have underlined the importance of secure energy supply in a volatile world. Electricity networks around the world are increasingly aware that renewables are the key to resolving this issue.

- Energy storage. A common complaint against solar energy is its inability to produce energy 24/7. Battery storage technology saw several breakthroughs in 2023, which have allayed a lot of the concerns voiced by governments and network operators.

Understanding the big 5 solar asset management trends in 2024: new tech powers smarter management

Smart solar Asset Management is going into the new year determined to make the most of technological advances which address the challenges posed by these factors. Below, we list the most important Asset Management trends for 2024.

1. Battery storage: The time of hybrid projects is here

As renewables generate an ever-greater share of electricity, then the focus shifts towards flexibility. For solar, maintaining output during periods when the sun isn’t shining occupies the minds of engineers, network operators and asset managers alike. Battery Energy Storage Systems (BESS) provide the solution, countering issues caused by network limitations and weather conditions.

Recent technological advances in BESS, such as greatly improved energy density, enhanced charging rates and a longer lifecycle have made solar-plus storage increasingly viable. This in turn has caused the market to grow steadily over the past two years and growth is expected to increase between 2024 and 2031, expanding at a CAGR of 27% during this time, according to recent market research. BESS solutions are also more flexible than before, ranging from containerised units to arrays of units in dedicated buildings. This allows for a BESS solution for all types of plant, taking on-site space, generation capacity and regional geography into account.

It is fair to say that in 2024 all new solar PV sites will have integrated storage as standard, while existing sites will need to be retrofitted. This will have its own implications for asset management, with conflicts and dependencies between solar and storage assets to consider. It will also factor into discussions between owners and AMs regarding revamping portfolios.

2. Upscaling: when size really matters

Growth in the solar sector shows no sign of slowing. This means more large-scale PV plants, but it’s important to note that there will also be portfolios comprising many small and medium-scale plants distributed over different areas.

In many ways very large sites are easier to manage. One major advantage is economies of scale, like the need to use only one set of subcontractors, thus saving time, labour, and money. Additionally, there is one local authority to deal with in the permitting process. The owners of these larger sites will probably have some form of in-house asset management, creating demand for companies able to provide bespoke services at a small and medium-sized level.

The real challenge for upscaling is when a portfolio comprises many different sites. These will most likely be the most common type, since most regions suitable for solar in Europe are not large, geographically homogenous areas easily connectable to energy networks, but small parcels of land between towns and villages. In this case, asset managers will need to deal with many different contractors and local authorities. While manageable for smaller portfolios, this is unsustainable at large scale. Greatly expanding asset management and engineering teams is impractical and prohibitively expensive – yet streamlining operations through automation is very difficult due to the fragmented nature of the portfolio.

The solution lies in integration through the value chain, where the upscaling trend dovetails with increasingly sophisticated software.

Asset management still relies too much on manual processes. Operators send PDF reports to AMs, who read them and copy sections into their systems – a recipe for inefficiency. As software becomes more powerful, smart asset managers will be building direct connections to operators’ systems, automating these interfaces to facilitate preventive maintenance and incident monitoring.

For this to work well, there needs to be common standards across the chain: common data structures used by everyone, so systems can easily communicate. One example of this would be the standardised mapping of components, so an operator can tag a report with a specific code, which immediately tells the asset manager which component(s) it relates to. This leads us to the next trend for 2024...

3. Smarter software optimises combined maintenance and management

Smart applications can make “Digital Twins” of a solar plant – working with a database to create a coded blueprint of an entire site or even portfolio. Utilising this model, condition monitoring software tracks the status of critical machinery and components while functioning, looking for fluctuations that indicate possible faults or developing issues, such as overheating or wear.

Until now, the constant issue of component failure has been dealt with by tried and tested methods of regular maintenance schedules, coupled with responding to machine failures as quickly as possible. However, vast component databases are now viable, administered by software that keeps track of an individual item’s operational lifespan and other important information.

This type of software – a Global Asset Register – is just beginning to be adopted in solar O&M, both for optimising maintenance and managing risks. Throughout 2024, we can expect more forward-thinking AMs and operators to use similar tech to reduce costs and improve reliability.

For now, the applications that create these databases and carry out Digital Twin modelling is bespoke software created by specific companies, such as Quintas Energy itself. Although the age of true standardisation is still a long way off, work is underway to coordinate the technical language used, bringing different systems closer together and making them increasingly compatible.

This is a pattern followed by all new technology – the evolution of personal computing from the 1980s to the present is a good example, whereby a plethora of different models of computer gradually consolidated, along with their programming languages, until we had the near-standard IT experience we use today. With the machine learning aspect of AI improving exponentially, we can expect to see component databases and risk management applications using “translators” and creating a common language for efficient information sharing.

Once again, these changes depend on greater partnerships between operators and asset managers. As AMs technically have access to more data, but operators are closer to the practical end of things, both will benefit from sharing information and more powerful ways of using it.

4. Revamping: facing up to ageing issues

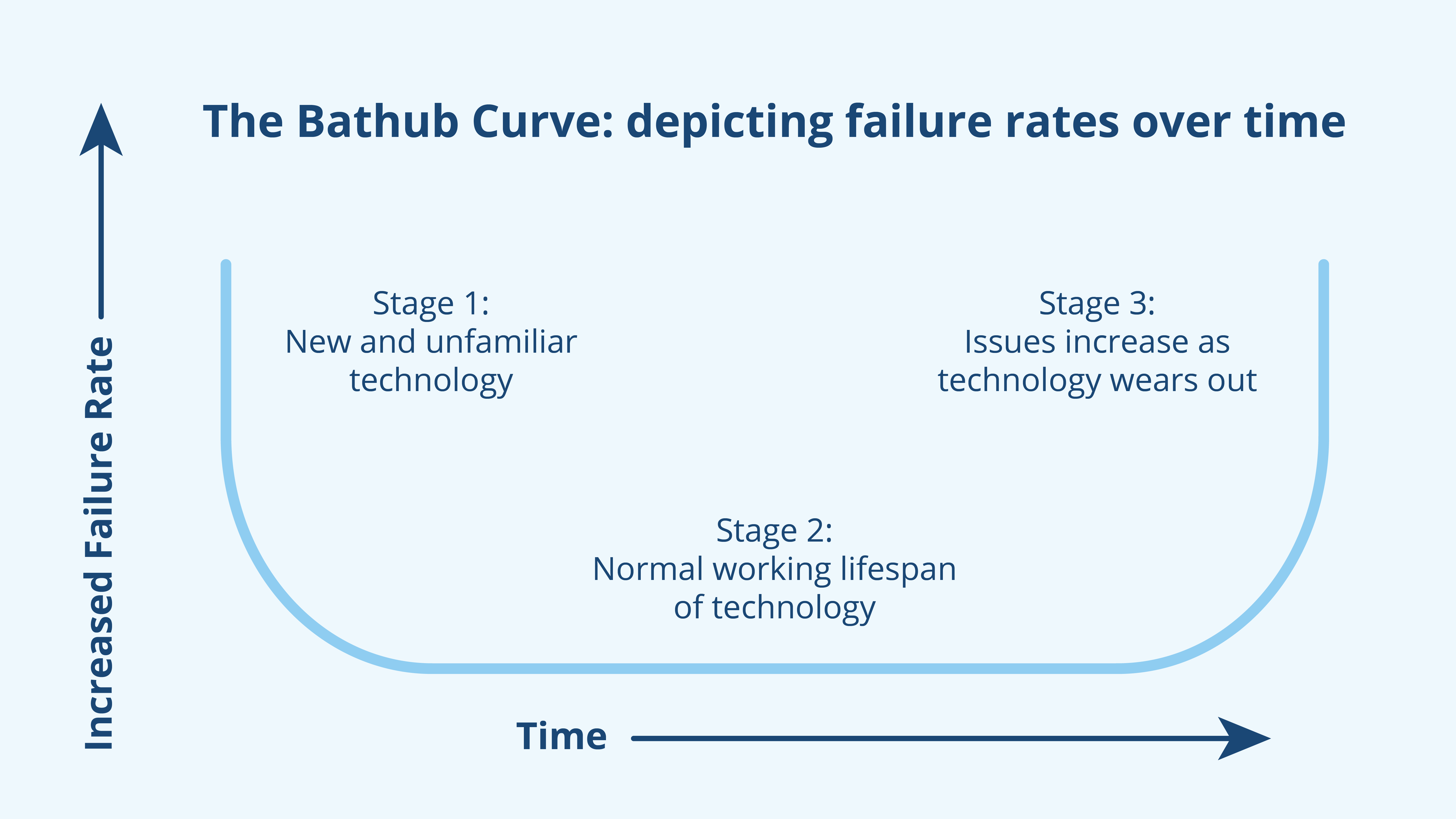

Like many complex projects, solar plants operate under general principles represented by the “bathtub curve”.

The curve shows the three stages of a project: the first represents “teething troubles”, caused largely by unforeseen issues with new and unfamiliar technology. These problems dwindle as the tech stabilises and operators become more familiar, leading to stage two, a lengthy period of largely trouble-free execution. Finally, we have stage three, where ageing infrastructure and components begin to wear out and malfunction, causing ever-growing maintenance and repair issues.

The last solar boom was about a decade ago, and solar PV plants built during this time are fast approaching stage three – a point where important decisions need to be made, all of which involve spending money. So, here’s the dilemma: to keep patching up these aging plants – despite deteriorating reliability and escalating O&M costs – or invest in a revamp with the latest panels, inverters, and transformers?

Either way, the decision will be final, no going back. There is also plenty of scope for mistakes. Making the best decision lies in knowing when stage two of the bathtub curve is about to become stage three and acting before that happens. To succeed here, owners need their AM team to weigh up technical issues, supply chain constraints, opportunities for standardisation, and much more, if they want to achieve value over the sites’ lifetime.

Smarter software will have another important role to play here. With a detailed knowledge of various components and their lifespans, due to the collation of manufacturing specifications and engineers’ reports in shared databases, 2024 will see it becoming ever easier to calculate when the time for a revamp is approaching. What’s more, Global Asset Registers and component databases will make it easier for engineers to know when it is better to repair or replace an item, thus better managing maintenance budgets by spreading costs, and making the assessment trade-off between repair or replacement that ultimately drives revamping decisions a more reliable process.

5. From firefighting problems to controlling risks

The shift in perspective that began last year is set to accelerate in 2024, fuelled by the growth of new technology like smart software and AI machine learning. This will drive a change of focus among asset and operations managers, from micromanaging incidents to managing risks. With overarching knowledge of the details of a portfolio, asset managers and engineers no longer need to be purely reactive and administrative. They will need to work closely together to create and maintain the knowledge infrastructure required to make smart risk management effective. If done well, this will make solar portfolios far more efficient, both operationally and economically.

This is why Quintas Energy is launching a Risk Management service, combining the latest advances in component and infrastructure databases, Business Intelligence, machine learning, and management reporting. The service works with clients to create their own Global Asset Register, and our experts help them manage a new comprehensive system which looks at the big picture, combining the strategic approach of good asset management with the practical know-how of the O&M team.

Harness the power of new tech with Quintas Energy

As we can see, the rapid growth of these new technologies is making intelligent solutions based on data not only possible, but essential for staying ahead of the game. With an emerging new paradigm for maintenance and management, it is important to introduce new processes that recognise and capitalise on it.

At Quintas Energy we have anticipated the important sectoral changes at the heart of these 5 solar asset management trends and adapted our services to address them, making use of innovative in-house tools and solutions. Contact our team do find out more details and discover how we can help your portfolio provide peak performance in 2024.