One of the most important aspects of any renewable energy portfolio is Project Financing. Without this, the project will not get off the ground. In almost all cases, this financing involves a loan.

A successful loan agreement requires a clear understanding of obligations from the outset and timely management of all its covenants. Ensuring all repayments and other agreements proceed smoothly requires a robust loan compliance process – something often better managed by outside experts.

Specialists delivering a massive range of services

Good loan compliance begins with core provision, overseen by an expert finance team. These involve:

- Managing payments and distributions under the loan agreement

- Preparing performance and operational reports

- Creating and amending loan agreement documents

- Submitting compliance certificates to the lender

- Managing reconciliations with bank notifications (fees, capital, interest repayments, MTM swaps etc.)

- Preparing semi-annual accounts

- Preparing annual budgets

- Calculating ratios (DSCR & others available on request)

- Managing Swap Hedging: partial & total cancellation and impact calculation

- Annual LC overview report; commentary on the Financing Agreement’s undertakings

- Assistance preparing other documents related to the loan/financing Agreement.

- Cash sweep reports

- Monthly email reminders to clients on deliverables to lender

- Managing lender communications regarding the Facility Agreement

- Assistance with waiver requests (due to an inability to meet covenants, or the Financing Agreement in general)

To perform these services efficiently requires precise knowledge and execution of an intimidating – and lengthy - list of business accounting procedures. With so many tasks, engaging experts for them saves time, money, and trouble. Compliance prevents unnecessary extra charges. A project that is out of compliance not only risks mounting costs, but also negative publicity and loss of trust. This can cause difficulties for the company beyond the financial.

A world of differences: how our Loan Compliance team does business

At Quintas Energy, our team has a wealth of experience managing project financials in several countries worldwide, with services provided in Spain, Italy, Finland, Israel, and the UK. It has managed around a billion loan agreements and overseen financing for 118 site projects. Of these, 109 are now fully up and running, with nine still under construction.

To provide its top-tier service, the Quintas financial team is familiar with many different types of financial instruments, contracts, and agreements, as well as knowing how to meet the various accounting and reporting standards worldwide. Let’s look at the most important ones:

Instruments

Although financial instruments take many forms, Loan Compliance is most interested in the different types of lending agreement. These are the most common.

1. Bond Trust Deed

This legal document comes into effect when one party takes out a loan from another to purchase a property. The deed is an agreement between borrower and lender for an independent third party to hold the property in trust until the loan is repaid.

2. Facility Agreement

Often referred to as a loan, credit facility agreement, or facility letter, this contract sets out the terms and conditions of an agreement between borrower and lender. Essentially, a short-term loan that does not require collateral.

3. Mezzanine Facility Agreement

This agreement allows the lender to convert outstanding debt to an equity interest in the company in the case of default.

Reporting

A huge part of Loan Compliance is the preparation of financial reports, to demonstrate accurate accounting, conformity with contractual terms, and most of all the correct observance of repayment schedules. This means that our compliance team must be familiar with various accountancy standards around the world.

Currently our Loan Compliance team works under different local Generally Accepted Accounting Principles (as UK GAAP, Spanish GAAP, Italian GAAP etc.), and under International Financial Reporting Standards (IFRS)

Seven examples of Quintas Loan Compliance services

Here you can see some examples of how the Loan Compliance team helps our clients, in more detail:

1. Drawdown preparation and communication with the lenders

Companies with solar projects in the construction phase require funding in stages from their bank, made available as sections of work are completed. These funding requests are called drawdowns. The process is complicated and time-consuming to administer, but far easier with the help of Quintas Loan Compliance.

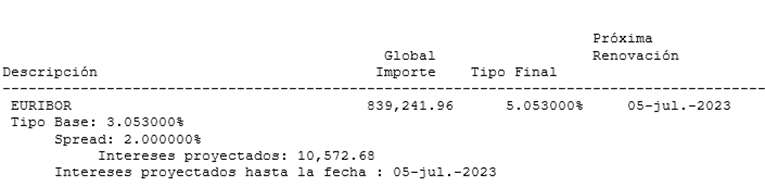

As construction phases are completed, our team compiles all relevant invoices and cross-references them with our database, before sending them to the lender as proof of eligibility for the drawdown. The day before receiving the requested funds, the lender notifies us of the Euribor-based interest rate to be applied to the exact amounts. This important as the rate is incorporated into our trackers to recalculate the total interest to be paid.

Even once the funds are received, Quintas’ accounting team checks for errors and Loan Compliance reviews the transfers before asking the client to sign for them. We then verify that all invoices have been paid in full. This is a painstaking process, but Loan Compliance takes the pain out of it for the client.

2. Reconciliations with bank notifications

Bank reconciliation is the practice of matching bank statements with business accounts to make sure that all parties are tracking payments accurately. This is a very beneficial accounting practice, since it allows lenders and borrowers alike to have confidence that a financing contract is being properly honoured. It also enables companies to know their records are up to date and accurate – and to pinpoint errors in good time, enabling corrective action to be taken by the borrower or the bank.

Given the large variety of payment methods available, as well as the complexity of financing arrangements for solar projects, the reconciliation process is extremely complicated and time-consuming for a small business. This is where Quintas Loan Compliance provides an expert team experienced in compiling and reviewing this mountain of data. Our team reviews the contractually agreed frequency of the loan follow-up, using the information in the trackers.

As well as checking for accuracy, every month Loan Compliance calculates interest accrual, how it varies between different lenders and contracts, and how it should be split between payments. It carries out a similar task for project finance costs and expenses, ensuring that the correct amounts get paid at the right times. The client remains informed, with detailed summaries, and the lenders can be assured that all contractual obligations are being followed.

3. Operating reports

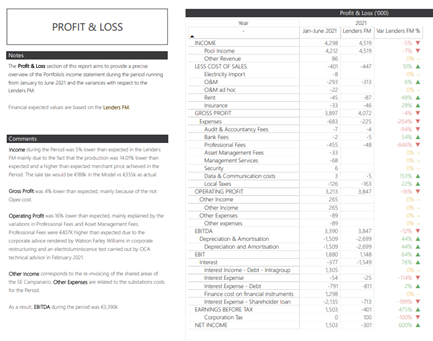

From time to time, financing contracts require a report containing information about obtained income, market evolution, price, costs, forecasts, production, and plants’ technical performance. The report will analyse and compare these parameters with those of the financial model, investigating and explaining any discrepancies. It will also detail any information about events potentially affecting the plants’ operation or performance, or any other impacting factors.

Loan Compliance gathers information from the different departments to compile this report for the bank by a given date. This is highly useful for all parties, as it allows benchmarking, tracking and confidence in the reliability of the financing process.

4. Preparation of the annual budget

The advantages of a clear and detailed annual budget are obvious: it helps keep a check on spending and gives project managers clear sight of future goals and obligations, in terms of achievability and affordability. For project financing, there is another important factor – banks usually require sight of a budget by a certain date as part of the loan agreement.

Loan Compliance is highly skilled in budget preparation and carries out this important task in collaboration with legal and technical departments as well as the client.

Moreover, Quintas keeps inspecting and analysing the budget on the Ariadne platform so it can compare the current profit and loss alongside the estimated version. Loan Compliance reviews the monthly closings, commenting on the most significant deviations.

5. Ratios Calculation

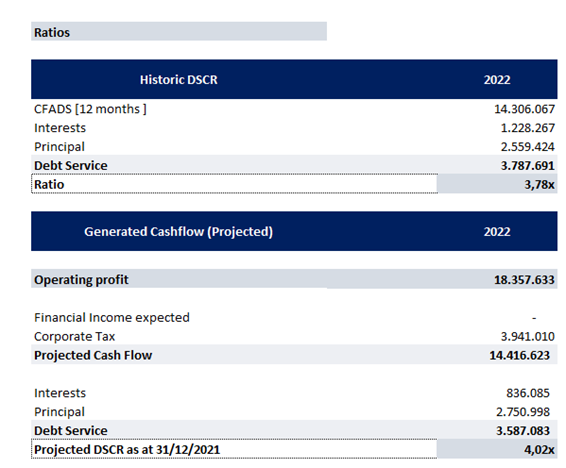

A key deliverable generally required by a financing agreement is the calculation of ratios and its reporting to the banks. This analysis and comparison offers valuable insights into a company’s financial well-being. It helps reassure lenders that a loan’s covenants will be honoured.

One of the most common ratios is Debt Service Coverage Ratio Calculation (DSCR), calculated by the borrower as a quotient between the cash flow and the debt service. Most financing contracts demand that this ratio remains below a set figure, so the borrower will not run into difficulty with payments.

Loan Compliance is experience in calculating such ratios at regular intervals contractually agreed with the banks, essentially reckoning whether there is sufficient cash flow to cover debt service, with a comfortable margin of error in case of unforeseen incidents. Once obtained, the ratio is shared with the client. Once it is approved, Loan Compliance sends it to the banks as a report.

6. Distribution calculation

If it is permitted by the contract, clients may ask Loan Compliance to calculate distributions. This means that the borrower wants to make payments among a variety of lenders or interested parties, as well as the principal lender.

In these cases, we follow calculation guidelines established in the contracts and verify that certain conditions have been fulfilled. Once the distribution calculations are shared with the client and they approve them, they are sent to the bank along with a distribution request.

7. Financial Model Updating

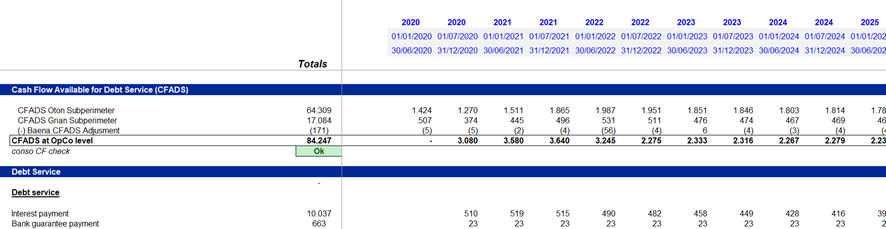

Every six months, the client compiles all its financial and technical information, to include in the portfolio’s Financial Model. All the relevant information is brought together in a consolidated view, enabling analysis of variations in the portfolio’s accounts:

Financial Models present different cases or scenarios, selected using commonly agreed criteria between the client and lenders. Sometimes modifications can be made to the model by considering new information, updating its assumptions to better predict the project’s future performance. Loan Compliance compiles the report and configures it for optimised insights, increasing the project’s financial efficiency.

All the above makes it clear how very complex project financing is, and how crucial it is to keep track of so many detailed processes. This is why the work of Loan Compliance is so important, helping the client to avoid missed repayments and other loan headaches.

Are you looking for a trusted partner for your financial procedures? Download our brochure and learn how we can help you.

.png?width=300&name=Loan%20Compliance%20for%20Renewables%20-%20Blog%20(1).png)