When zero and negative energy prices first appeared in Europe in the late 2000s, they were provoked by the rapid growth of renewable sources in the continent’s first green energy boom. Since then, they have become a seasonal fixture in many places, due to oversupply in the summer when solar is at its peak and in the winter when wind farms are busiest.

On 1 April this year, the Spanish energy market reported negative prices for the first ever time, but this was no April Fool’s prank. The event followed the Spanish-Portuguese MIBEL market registering the lowest prices in Europe for the eighth week in a row, with both phenomena caused by a combination of lower demand and greatly increased production from renewables – particularly wind power, which responded well to an extended period of stormy weather.

There are systemic solutions to negative prices, such as demand-side responses and more integrated markets. There is also the urgent need to drastically ramp up energy storage technologies, which is thankfully being addressed. But this still leaves owners and operators with the issue of how to deal with overproduction and its effect on revenues, which can be a very complicated business.

Revenue Management Challenges for Solar Projects

In 2023, the EU Agency for the Cooperation of Energy Regulators (ACER) said that the highly volatile market meant that energy pricing remained an issue, despite falling wholesale prices. ACER explained that suppliers are constantly having to buy in to meet expected future demand, which exposes them to risk of potential losses.

To try and hedge these risks, energy suppliers often make revenue management a top priority. In any industry, revenue management systems aim to optimise income by getting the best price. This is largely achieved by predicting customer demand over set periods of time, and devising sales strategies to make best use of this information.

It is easier to mitigate the risk of losses when you can see which way the market is blowing. This creates a set of new challenges:

- Complexity of data and calculations. A volatile market is a highly complex market, with a dizzying number of variables constantly in a state of flux. What is worse is that processing and analysing this torrent takes a huge amount of time and effort without guaranteeing success, since there always remains a high possibility of error.

- Confusing contracts and sales schemes. Suppliers must frequently deal with several different markets and offtakers. Energy sales deals are contractual agreements, requiring further monitoring to ensure that obligations are fulfilled, and any disagreements resolved. Dealing with this further layer of complexity can prove a real headache for suppliers.

- Lacking a bird’s eye view. Trying to manage a flexible revenue strategy and avoid errors is a lot more difficult without a strategic overview. Getting a sense of the big picture is nearly impossible when trying to piece together fragments of data manually.

Thankfully, Quintas Analytics has a range of bespoke automated solutions which have been designed to take the pain out of these challenges – practical remedies which have been proven in the field. Let’s look at three examples.

Three times Quintas Analytics automated solutions resolved revenue riddles

Although they share similar aspects, revenue management challenges take many different forms, depending on circumstances. For this reason, Quintas Analytics automated solutions are tailored to each client’s individual situation. Here are three real examples from our case studies collection illustrating some of the problems that can arise and how we can help:

1. Optimising revenue management with accurate revenue estimation

Naturally, the challenges detailed above deepen complex the larger the portfolio becomes – as can be seen with this example. The client owns a portfolio of 500 PV installations in Spain, with an average size of 5MW.

Large portfolios such as this one often utilise a mixed energy sales strategy, with some of the power being sold under a PPA (Power Purchase Agreement) with a designated offtaker. Producers then seek to sell the remaining energy on one of the energy markets.

There are two challenges with this approach – one for each selling method. With the PPA, the challenge is one of contractual compliance and accuracy: the offtaker’s invoices need to match production and any discrepancies must be quickly identified to the offtaker, so a claim can be made. With energy sold on the markets, suppliers need to stay on top of fluctuating prices – especially in this time of negative pricing – to accurately estimate possible revenues.

Clearly, this involves sifting a massive amount of production and market price data, a mammoth task for management teams. The work involved in evaluating both PPA and market revenues, alongside contractual calculations, increased the workload further, with a high risk of errors and a constant need for follow-up checks. Additionally, the inefficiency of manual processing made filing accurate and timely claims for discrepancies a very hit-and-miss process.

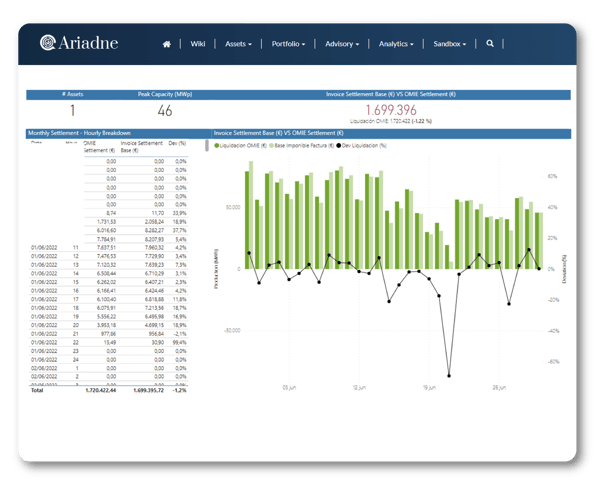

Quintas Analytics devised an automated solution which drastically reduced the amount of manual work, by automatically collecting and integrating all data, before calculating probable revenues based on hourly market figures and fixed prices under the PPA contract. The solution then used an algorithm to compare invoiced and actual production monthly and identify deviations. When a discrepancy was found, claims were automatically emailed to the offtaker along with details of the asset and period affected and all necessary documentation.

The automated solution saved the AM team a mountain of time and manual work, as well as increasing the accuracy of revenue provisioning, while increasing the speed of claims with the offtaker and ensuring the claims were legitimate. This presents a robust response to the uncertainties and headaches caused by a volatile market prone to periods of negative pricing.

2. Accurately Estimating Revenue for a Complex Sales Scheme and Detecting Deviations

Automated solutions are not only a lifesaver when it comes to boosting the efficiency and cutting workload associated with revenue management, they also have a key role to play in optimising sales strategy. In this case, the client owned a smaller portfolio of 15 PV assets in Spain but utilised a similar revenues method as the previous example, with a daily percentage of energy produced sold under a PPA and the remainder in the day-ahead market.

In this case, with a more manageable number of assets, the biggest challenge came with estimating daily revenues – particularly when considering the best possible returns that could be made using different sales schemes and in different markets.

The problem here was one of flexibility: trying to analyse the pros and cons of various schemes to decide which offered the best return was laborious, involving a great deal of number-crunching, and near-impossible attempts to keep pace with constant changes in the markets. Without the ability to continuously monitor the sales strategy’s profitability as compared to alternatives, visibility was limited without continuous estimated revenue data – as was the AM team’s capacity to make well-informed decisions.

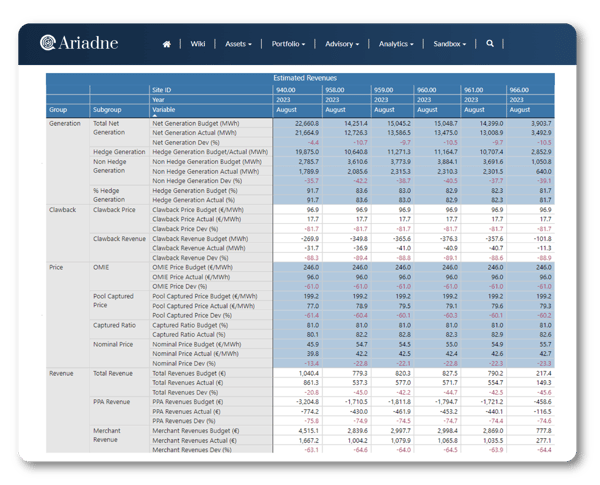

The automated solution that Quintas Analytics came up with not only dealt with the data collection and processing, it also estimated daily revenues based on real production data and real-time market prices. The algorithm went on to compare these estimates with hypothetical revenues that would have been obtained using different sales schemes, and in the balancing markets, based on real prices. Key points and conclusions were compiled in daily notifications and reports to management, showing revenue comparisons and the results of different strategies – including the share of assets in balance sheet markets.

The result of this was optimised revenue and a more effective strategic overview on the part of the management team, which improved its decision making and operational efficiency. In a market prone to volatility and the seasonal incidence of negative pricing, having an accurate, constantly updated flow of market information will help AMs formulate a superior sales strategy.

3. Analysing Energy Sales Strategy to Maximise Revenue for a Hybrid Storage Portfolio

One of the ways that renewables can counter the irregular surges in supply and demand that cause negative or nil pricing is through storage. As battery technology continues to improve in efficiency and capacity, storing excess energy until it is needed is becoming an increasingly viable way to prevent waste and loss of revenue. However, to do this properly, a hybrid storage portfolio needs to know the optimal times for charging and discharging the battery arrays – and to make this possible, asset managers require an accurate and up to date view of the market.

The client in this case owned a portfolio of five battery-hybrid PV assets in the UK and was looking to maximise revenue through a more efficient battery charging and discharging strategy. To do this manually was proving to be a real headache, as too much time was spent trying to analyse loading, unloading, price and market data, with the constant possibility of human error. On top of this, it was difficult to see for sure whether the current loading strategy devised by the management team was effective in maximising revenue, due to the impossibility of maintaining a constant overview. The patchy nature of the available data led to incomplete manual analysis, which hampered strategic decision-making.

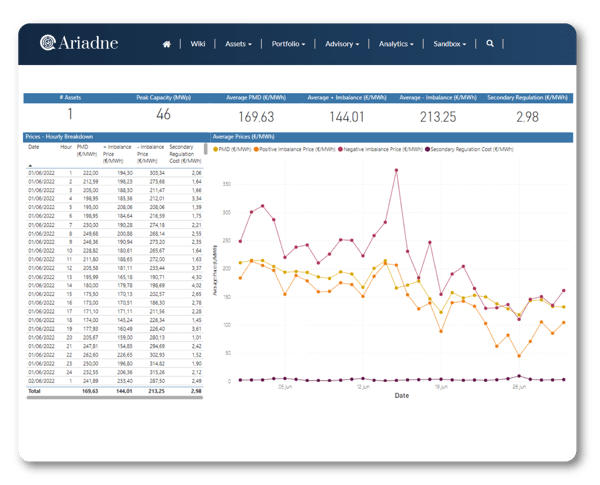

The Quintas Analytics automated solution aimed to streamline the data processing aspect and integrate it seamlessly with the analysis. To do this, it automatically calculates the daily level of battery charge and the optimal periods for charging and discharging. With an ongoing understanding of the batteries’ value, it can accurately estimate revenues and costs. Additionally, it compared the batteries’ overall optimal value with that obtained using the market agent’s current sales strategy, allowing management to see whether this was the right one. Finally, the solution provided the management team with daily notifications and reports, complete with results and comparisons.

Once implemented, this solution proved an immediate success, improving profitability and providing the AM with more informed and insightful decision-making. The time saved by process automation, daily calculations and automatic benchmarking made the sales strategy more efficient and management better able to coordinate a flexible response to the fluctuations in both the market and production.

In a sector where battery storage systems are only becoming more essential, such a powerful tool can really make a difference, especially when it comes to mitigating the risk of negative pricing.

Overcome market uncertainty with our automated solutions

Although all of these case studies benefit from the automation of data collection and processing, each focuses on a different aspect of running an efficient renewables portfolio in the age of production peaks and troughs, and the resultant periods of negative and zero pricing. With the accuracy and analysis that automated solutions can provide, it is possible to mitigate the ill effects of these periods and devise robust strategies that maximise production and energy sales.

Are you seeking to optimise your revenue management and avoid the pitfalls of negative or nil pricing?